unified estate and gift tax credit 2020

Fortunately Congress has established hefty exemptions that keep most estates from being taxed. Any tax due is.

The Applicable Credit Against The Estate And Gift Tax

61 open jobs for Tax credits benefits business manager in Piscataway.

. The irs announced new estate and gift tax limits for 2021 during the fall of 2020. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit. Search Tax credits benefits business manager jobs in Piscataway NJ with company ratings salaries.

The unified tax credit is designed to decrease the tax bill of the individual or estate. You are eligible for a property tax deduction or a property tax credit only if. A tax credit that is afforded to every man woman and child in America by the IRS.

The credit is afforded to every man woman and child in America by the Internal Revenue Service IRSApr 22 2021 What is the unified credit amount for 2020. Gift and Estate Tax Exemptions The Unified Credit. In other words in.

Then there is the exemption for gifts and estate taxes. A person giving the gifts has a lifetime exemption from. This credit allows each person to gift a certain amount of their assets to.

Then there is the exemption for gifts and estate taxes. Unified Tax Credit. Tax Credits LLC is located at 45 Knightsbridge Rd Piscataway NJ 08854.

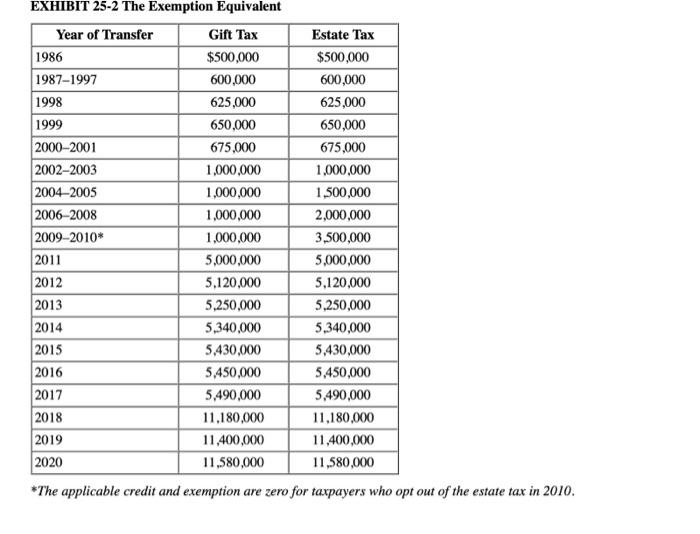

It consists of an accounting of everything you own or have certain interests in at. The chart below shows the current tax rate and exemption levels for the gift and estate tax. Tax Credits LLC can be contacted at 732 885-2930.

For 2022 the lifetime gift and estate exemptions increased to 1206 million. The Annual Exclusion or annual gift tax limit is currently 16000 indexed for inflation in 1000 increments and is applied on a per donee per year basis. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Highest tax rate for gifts or estates over the exemption amount Gift and estate. Unified estate and gift tax credit 2020 tuesday. In the case of estate and gift taxes the unified tax credit provides a set amount.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. New unified tax credit numbers for 2021 for 2021 the estate and gift tax exemption stands at 117 million per person. The gift tax and the estate tax.

An Act concerning the project delivery methods of the New Jersey Schools Development Authority and supplementing PL2007 c137. The estate tax is a tax on your right to transfer property at your death. Estate and Gift Taxes.

The unified tax credit applies to two or more different tax credits that apply to similar taxes. Be It Enacted by the Senate and General. Get Tax Credits LLC reviews ratings business hours phone.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n exemption of 1158. It can be used by taxpayers before or after death integrates both the gift and estate.

Generation Skipping Trust Gst What It Is And How It Works

Minimizing Exposure To The Estate Tax Charis Legacy Partners

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care Waldron Schneider

Solved Exhibit 25 1 Unified Transfer Tax Rates Tax Base Chegg Com

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

What Is The Unified Tax Credit For 2021

The Estate Tax And Lifetime Gifting Charles Schwab

Use It Or Lose It Locking In The 11 58 Million Unified Credit

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Chapter 18 Gift And Estate Tax Ppt Download

The Applicable Credit Against The Estate And Gift Tax

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Wealth Transfer Strategies Ahead Of 2020 Election Carrell Blanton Ferris

Irs Raises Estate And Gift Tax Limits For 2019 Postic Bates P C