michigan sales tax exemption rules

Sales of vehicles to members of armed forces. Commissions paid to entities exempt under MCL 20554a.

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

. Tax on sale of food or drink from vending machine. Sales to the American Red Cross and its chapters and branches are exempt. 20 rows Sales Tax Exemptions in Michigan.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act. Get Your Maximum Refund With TurboTax.

File Your Federal And State Taxes Online For Free. In Michigan certain items may be exempt from the. For Resale at Wholesale.

Government Sales to the United States government the State of Michigan and its political subdivisions departments and institutions are not subject to tax if the sales are ordered on the government form or purchase order and are paid for directly to the seller by warrant on government funds. Ad Sales Tax Exemption Michigan information registration support. Print eBook Format.

Print Digital Format. No tax is due if you purchase or acquire a vehicle from an immediate family member. Tax Exemption Between Relatives If you purchase or acquire a vehicle from another person 6 tax is due of the full purchase price or fair market value whichever is greater.

The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals. Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product. Rentals and Leases - A registered lessor in Michigan has the option of paying six percent Michigan Tax on the acquisition of tangible personal property.

This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections. Sales exempt from tax. Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520.

Church Government Entity Nonprofit School or Nonprofit Hospital Circle type of organization. Rules and Regulations for the State of Michigan. The law defines bullion as gold silver or platinum in a bulk state where its value depends on its content rather than its form with a purity of not less than 900 parts per 1000 Investment.

Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. Do not send a copy to Treasury unless one is requested. Rankings by State Sales Tax Only.

Michigan Department of Treasury 3372 Rev. Get Your Max Refund Today. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372.

Streamlined Sales and Use Tax Project. Discounts will apply on 23 06667 of the tax collected at the 6 percent rate. The purchase or rental must be for University consumption or use and the consideration for these transactions must move from the funds of the University of Michigan.

New State Sales Tax Registration. The following exemptions DO NOT require the purchaser to provide a number. See Notice of New Sales and Use Tax Requirements for Out-of-State Sellers.

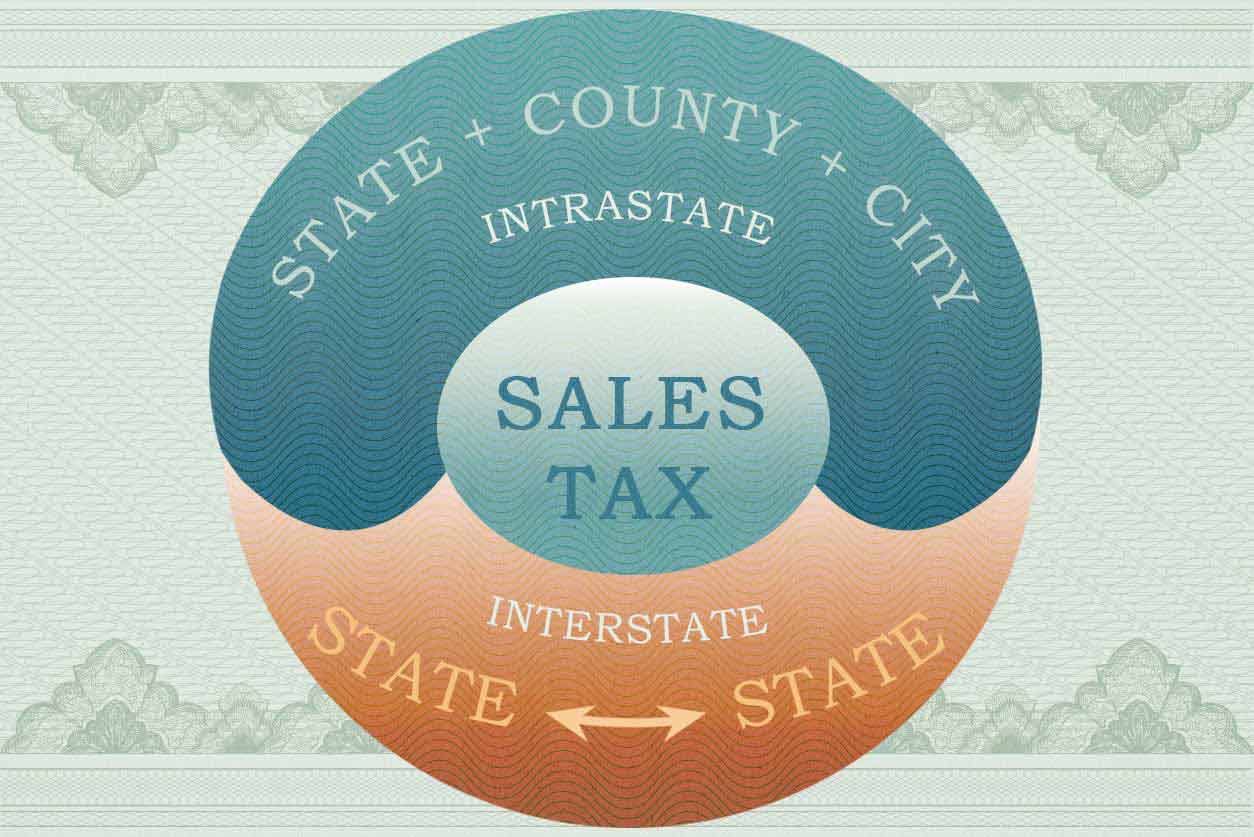

Taxes paid on or before the 20th are discounted 12 of 1 percent. Leading Resource For Practitioners. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 6 when combined with the state sales tax.

Ad Your Key Sales Use Tax Reference. For transactions occurring on or after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan. The following exemptions DO NOT require the purchaser to provide a number.

Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization. For Resale at Wholesale. Both of these documents are required to be completed for the retailer selling the materials to the contractor to keep in their files.

Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be exempt from sales tax. 01-21 Michigan Sales and Use Tax Certificate of Exemption. Michigan has a statewide sales tax rate of 6 which has been in place since 1933.

Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. Additional sales excluded from tax. According to the General Sales Tax Act Section 20554s a sale of investment coins and bullion is exempt from the sales tax.

Any portion of sales or use tax paid on or before the 12th of the month is discounted 34 of 1 percent. To claim exemption from Michigan sales or use tax that contractor must provide a completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption and provide a copy of Form 3520 that you received from your customer. Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520.

Do International Sellers Have To Deal With Sales Tax In The Us Sales Tax Tax Seller

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

Download Policy Brief Template 40 Brief Policies Ms Word

Michigan Sales Tax Small Business Guide Truic

Requirements For Tax Exemption Tax Exempt Organizations

Sales And Use Tax Sales Tax Information Tax Notes

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Sales Tax For Small Businesses Truic

Sales Tax By State Is Saas Taxable Taxjar

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Avalara Tax Changes 2022 Read This Now Thank Us Later

Assignment Sheet Template Beautiful 14 Trademark Assignment Forms Pdf Doc Assignment Sheet Assignments Essay About Life

Michigan Sales Tax Exemptions Agile Consulting Group

Avalara Tax Changes 2022 Read This Now Thank Us Later

Taxjar Coupon Codes 50 Off Taxjar Com Discount Promo Codes Sales Tax Tax Online Seller